chase bank loan modification class action lawsuit

Loan modification class action lawsuit This lawsuit challenges GMAC Mortgages practice of filing a certificate and affidavit in support of the Maine expropriation falsely claiming that it is based on the petitioners personal knowledge and that it is signed in front of a notary. A recent class action against chase was because chase removed long standing lines of credit and reduced the amount available on their credit card.

Jpmorgan Chase Mortgage Modification Class Action Settlement Top Class Actions

A class action suit should be levied against Chase Mortgage for loan modification fraud.

. Whereas Chase Bank charges a fee for cashing checks drawn against their own bank and whereas this fee is unlawful and unethical we are filing this suit to recover fees paid and any punitive damages that the jury finds appropriate. After the credit card issuer more than doubled minimum monthly payments and imposed an Account Service Charge on customers who had accepted its fixed-rate balance transfer offers. This is usually done when the bank makes changes to the terms of the loan thereby changing.

Most executives of small companies would rather spend a day at the dentist than 45 minutes negotiating a loan with a banker. The plaintiffs have argued that the banks actions are illegal and discriminatory. You may be eligible for this if you meet all of the following requirements.

A class action lawsuit has been filed against Chase Bank USA NA. NEW YORK Reuters - A federal judge rejected JPMorgan Chase Cos JPMN bid to dismiss a lawsuit accusing it of misleading thousands of. After the credit card issuer more than doubled minimum monthly payments and imposed an Account Service Charge on customers who had accepted its fixed-rate balance transfer offersThe.

Chase Bank Class Action Lawsuit. Both companies are accused of withholding needed information and making false statements to force borrowers into mortgage modification. District Court Southern District of California alleging among other things that Chase Home Finance JPMorgan Chase reneged on a promise to modify.

You have a mortgage loan that is not owned or insured by a government agency or government-sponsored entity. Chase Modification Program CHAMP expand. Loan modification class action lawsuits against these bankssimilar to the 2015 class action involving Chase Bank which the bank agreed to settle for an undisclosed sumare now forming.

SAN DIEGOA proposed class action lawsuit has been filed in US. Each participant got only a few hundred. They also allege that their lender was required to disclose the full details of their mortgages to the public.

If you need reissuance of the Step 1 or Step 2 Settlement payment please follow the instructions on this website or call the Settlement Administrator at 1-800-419-5246 Monday through Friday between the hours of 800 am. I was essentially guaranteed it would only take 3 months but still no answer. Chase Bank was recently sued by a class action lawsuit against them.

Task Force Files Mortgage Fraud Lawsuit Against JP Morgan Chase. Federal court in Southern California against JPMorgan Chase Bank alleging the bank has charged customers overdraft fees on debit transactions even though they didnt actually overdraw their accounts. We are also filing this suit to recover exorbitant account fees charged by Chase Bank to their.

The Residential Mortgage-Backed Securities Working Group. A class-action lawsuit against JPMorgan Chase Bank has been filed against the bank. It is not a personal mortgage fraud claim.

I started this process in Feb. 09 and it is now 17 months later and still no answer. Bank statement loans are a.

Campusano is one of two named plaintiffs in a proposed class-action lawsuit alleging. The lawsuit stuck and it was for 2 mil. Please only contact Berger Montague if you know of a company committing mortgage fraud against the US.

This multinational bank has over 5100 branches with 16000 atms employs over 250000 staff and. You may qualify for a modification on your first lien through the Chase Modification Program. This was in santa clara county.

Most class action lawsuits do not yield much in the way of monetary settlement for the participants. Proposed Class Action Lawsuit Filed Against JPMorgan Chase Over Overdrafts. Chase doesnt refinance student loans.

The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. You may be eligible if you meet all the following requirements. JPMorgan Chase fails to end mortgage modification lawsuit.

The lawsuit was filed by a group of Chase customers that say they were deceived into dealing with Chase through an unsecured loan that later cost them their home. For most class members this will be your only payment. You hear a lot about class action lawsuits these days.

The Residential Mortgage-Backed Securities Working Group. Loan modification class action lawsuits against these bankssimilar to the 2015 class action involving Chase Bank which the bank agreed to. JPMorgan Chase or JPMorgan collectively Chase or Defendants in US.

The reason this class action lawsuit was filed is due to the way Chase Bank advertises its services. Task Force Files Mortgage Fraud Lawsuit Against JP Morgan Chase. The plaintiffs in the JPMorgan Chase mortgage modification class action lawsuit claimed that JPMorgan Chase was liable for breach of contract unfair trade practices and other violations of the law.

JPMorgan Chase has denied any wrongdoing and contends that it has fully complied with the law. Homeowners nationwide who modified their loan under HAMP with one of these banks may be entitled to financial compensation. The third class action lawsuit targets Bank of America and Chase Bank.

JPMorgan Chase Co which does business as Chase Bank is on the receiving end of a proposed class action over alleged Fair Debt Collection Practices Act FDCPA violations. Plaintiffs say that they are owed an equal amount in damages and are owed compensation for being wronged by Bank of America and Chase Bank. Hagens Berman 206-623-7292 may be involved in a class action lawsuit on behalf of Chase customers who have been attempting to modify their mortgage loans.

Those requests will be honored at the. I started the process of modifying my loan after my income fell by more than 50. Campusano is one of two named plaintiffs in a proposed class-action lawsuit alleging.

This case is about fraud committed against the United States government. A class action lawsuit has been filed against Chase Home Finance LLC Chase Home Finance and JPMorgan Chase NA. The Class Action lawsuit refers to an instance in which several hundred or even a few thousand plaintiffs receive a claim for compensation after being improperly and repeatedly denied of their right to file a loan modification with the bank of America.

Chase Bank Agrees To Pay Homeowners 11 5m To Settle Escrow Interest Class Action Lawsuit Lieff Cabraser

Wells Fargo Home Loan Class Action Settlement Top Class Actions

Special Investigation How America S Biggest Bank Paid Its Fine For The 2008 Mortgage Crisis With Phony Mortgages The Nation

Jpmorgan Class Action Says Bank Forecloses Homes Without Notice Top Class Actions

Chase Bank Military Member Fees Class Action Settlement Top Class Actions

Boeing Sedang Terpukul Tiongkok Borong 300 Pesawat Airbus Dari Eropa Pesawat Udara Pesawat Eropa

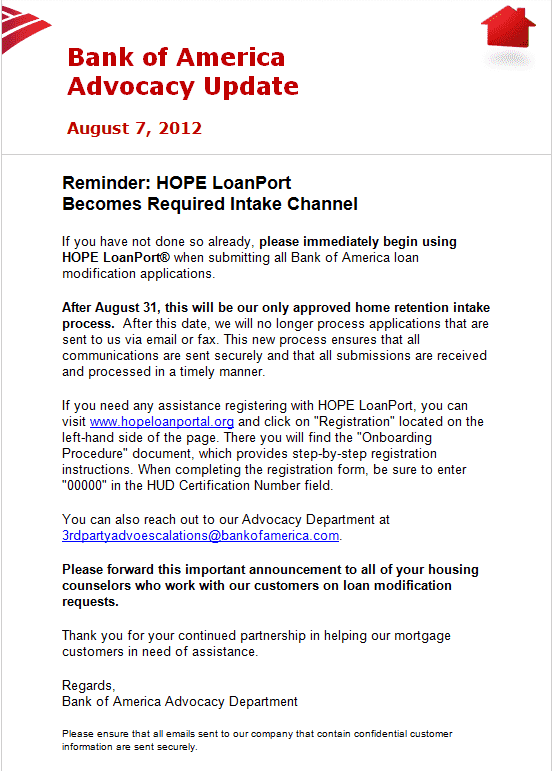

Hope Loanport R And Your Loan Modification Sulaiman Law Group Ltd

U S Judge Rejects Bofa Mortgage Modification Class Action Bank Of America Getting Into Real Estate Dividend Investing

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Class Action Lawsuit Against Chase Mortgage Fraud Lawyer Aspect

I Can T Make My Mortgage Payments How Long Will It Take Before I Ll Face Foreclosure Consumer Financial Protection Bureau

Us Bank Class Action Lawsuit Mortgage Lawvv

Wells Fargo Can T Escape Software Glitch Class Action Top Class Actions

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Bank Of America 75m Improper Fees Class Action Settlement Top Class Actions

A New Mortgage Rule Aims To Speed Modifications And Slow Foreclosures The New York Times