tax shelter meaning in real estate

Yes it is because it shelters your income. We have compiled some of the most effective and attainable tax shelters as well as information on how to use them to your advantage.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

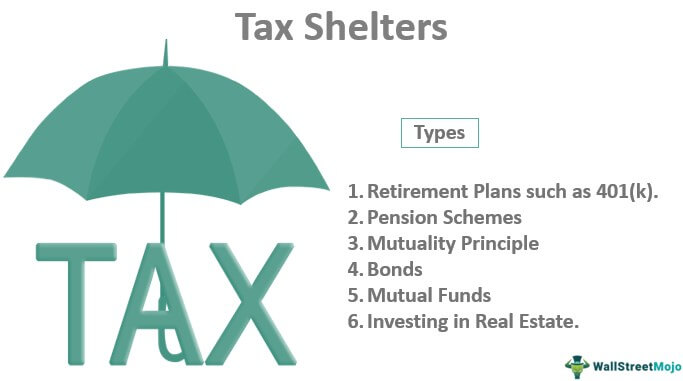

By definition tax shelters are methods which help you reduce your tax bill.

. Those who itemize deductions on their federal tax returns can deduct mortgage interest and property taxes. Is Real Estate a tax shelter. 461i3 provides that the term tax shelter.

As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. It is a legal way for individuals to stash their money and avoid getting it taxed. The IRS allows some tax shelters but will not allow a shelter which is abusive.

While taxes are inevitable using tax shelters can help reduce and legally avoid certain expenses. What is the Definition of a Tax Shelter. Real Estate Partnerships and the Looming Tax Shelter Threat.

The term tax shelter means. But according to The Nation the rich are using it as a tax shelter. 448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec.

Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2. There wont always be significant real estate investment tax shelter benefits when you are flipping a house because odds are you sell the property within a year of purchasing but every little bit helps. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. Here are some of the best ways to shelter your income from Uncle Sam. Amelia JosephsonDec 11 2019.

Think of tax shelters as your financial bottom lines best friend. For example there are several retirement plans available for any individual to opt for that help reduce tax liabilities. A tax shelter is a tool to reduce or eliminate taxes.

The failure to report a tax shelter identification number has a penalty of 250. In other cases real estate or non-real estate businesses or endeavors may seek to rely on the small business exception under. Investing In Real Estate.

Any syndication with the meaning of section. A number of real estate tax shelter exist. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. Business interest limitation and the tax shelter rules. 448a3 prohibition defines tax shelter at Sec.

The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business. But there is a catch whenever you depreciate the property it does not mean that you are tax free. Before we dive into all the important reasons why tax shelter is something you should be knowledgeable about its best to get this burning question out of the way yes tax shelters are legal.

Historically real estate has proved to be a significant tax shelter. Purchasing real estate has several tax advantages. Most business owners depth of understanding of a tax shelter is that it has something to do with the avoidance or evasion of tax which makes sense.

Despite all the publicity to the contrary tax shelters are alive and well. Many touted the tax reform legislation known as the TCJA as the most significant change to the Internal Revenue Code IRC since the Tax Reform Act of 1986. In 2011 Michael Dell reportedly qualified his 714 million 1757-acre Texas ranch for.

While those reactions are most assuredly true the proclamations were made at a time when there was substantial uncertainty. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs. Common examples of tax shelters are home equity and 401k accounts.

A tax shelter is a legal way of investing in certain plans or schemes that reduce the overall taxable income of the taxpayers and therefore save the taxes that are paid to the state or federal governments. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. What is a Tax Shelter.

So the investor has 5000 spendable cash in his or her pocket. Purchasing real estate is another way to set up a tax shelter because you can claim several deductions that renters cannot. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man.

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. Many real estate transactions will be subject to the election to avoid the new interest limitations that is available to real estate trades or businesses. If your Adjusted Gross Income AGI is 100000 or less you can deduct up to 25000 in losses for rental property which you actively manage.

Many people think of tax shelters negatively but they are completely legal and legitimate ways to decrease your taxable income. The IRS allows you to deduct qualified expenses related to owning a home including real estate taxes home mortgage interest and. Furthermore property often rises in value year after year.

There is a penalty of 1 of the total amount invested for the failure to register a tax shelter.

Tax Shelters For High W 2 Income Every Doctor Must Read This

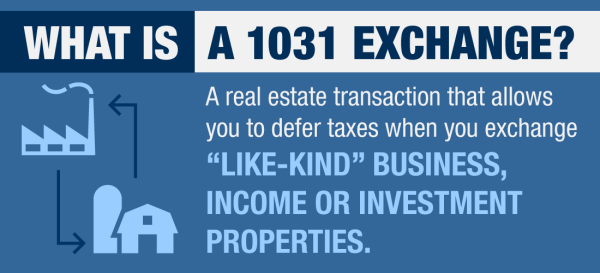

Are You Eligible For A 1031 Exchange

Get Expert Property Investment Advice Selling House Home Inspection Property Management

How Is A Tax Shelter Calculated In Real Estate

Marital Deduction Lifetime Gifts Estate Tax Exemptions Palm Springs Palm Desert Savings Strategy Estate Planning Tax Exemption

Keys To Getting A Condo Mortgage Tips Home Mortgage How To Apply

New Balance Sheet Download Xls Xlsformat Xlstemplates Xlstemplate Check More At Https Mavensocial Co Balance Sheet Download

Tax Benefits Of Investing In Real Estate Indiabulls Real Estate Blog

Need Retirement Inspiration Delaware S Tax Benefits Are Sure To Impress Learn More At Noble S Pond Tax Gas Tax Delaware

Real Estate Related Services Isyeri Istanbul Ofisler

Property Tax In The Netherlands

Tax Shelters Definition Types Examples Of Tax Shelter

Pin By The Project Artist On Understanding Entrepreneurship Apartment Room Understanding

Tax Shelter Definition Examples Using Deductions

What Is The Biggest Tax Shelter For Most Taxpayers

Preparing Your Community For Opportunity Zones Opportunity Capital Gain Track Investments

The Biggest Mistakes Home Buyers And Sellers Make The Wall Street Journal Real Estate Tips Organic Lemons Real Estate Buying

:max_bytes(150000):strip_icc()/Tax-Free-Municipal-Bond-Investing-57a525da3df78cf459871531.jpeg)